Resurgence In Indian Financials

June 2016

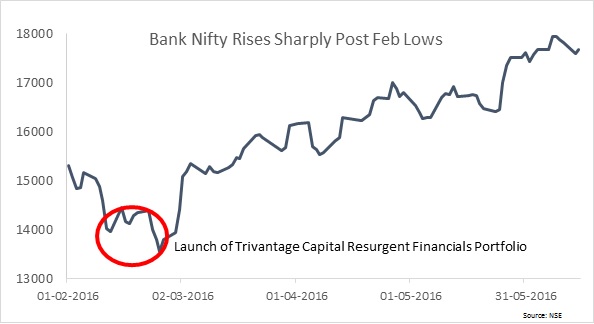

Trivantage Capital is pleased to advise that its maiden portfolio of Resurgent Financial stocks has generated 34.7% absolute returns since its inception on February 16th 2016. The portfolio has outperformed the benchmark Nifty Bank by 10.7%*.

We are quite happy that we called the turning of the cycle (as seen in the chart) in mid-February spot on just after the Q3 results of the large corporate lenders started disappointing the street. Most of these banks had suffered huge losses due to extremely aggressive provisioning requirements imposed by RBI’s (India’s central bank) asset quality review.

We took a bold call that the Government in the Feb 29th budget would firmly opt for the path of fiscal prudence and announce a strong commitment to stand behind the banks and that RBI will also support the Government in their efforts. Our interactions with credit rating agencies reaffirmed the basis of our strong contrarian call. We continue to be optimistic on the resurgence in earnings and other performance metrics of such lenders which have upfronted the pains and still maintain high levels of capital adequacy.

Our focus on Indian Financials is helping us spot opportunities for our investors across the capital structure of a financial entity in India. We were the first asset managers to identify the opportunity of investing in tier 1 bank capital bonds. We are constantly challenging ourselves to offer innovative investment solutions to our investors.

* Past performance may or may not be sustained in future. Investors are requested to read the disclosure document carefully before investing.