AT1 Market In India Takes Off

January 2017

- Indian banks need USD 90 billion capital by March 2019; 30 billion would need to come from AT1 issuances.

- A few better capitalised banks will access offshore markets to raise money following SBI’s lead.

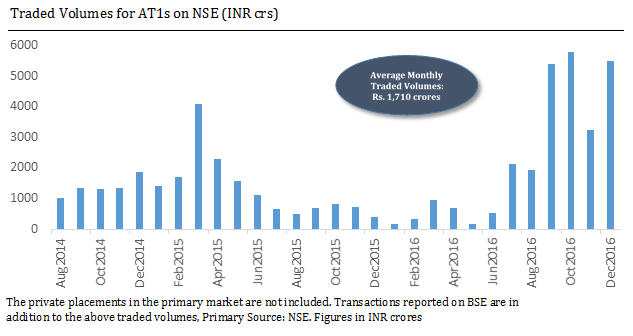

- Secondary market liquidity is improving with volumes crossing INR 50 billion in December 2016.

- Demonetisation is helping improve the credit metrics of several state owned banks. There has been a record jump in low cost CASA deposits (more tilted towards SA). Considerable gains in Net Interest Income due to this spurt in CASA deposits and combined with an increase in treasury gains due to fall in GOI bond yields, many banks have the opportunity to show improvement in provision coverage ratios and profitability.

- Since the credit growth for most PSU banks is around 5% YoY, the consumption of tier 1 capital is very less. This would improve the ‘margin of safety’ from the minimum required Tier 1 capital levels of 8.25% on 31 March, 2017.

- Based on interactions with bank managements and rating agencies, we believe that for many PSU banks, the stressed assets have peaked and in the coming quarters, we will see recoveries exceeding the incremental growth in GNPAs thereby reducing the overall level of stressed assets.