Sovereign Upgrade : A Structural Positive For The Indian Financial Sector

November 2017

The first sovereign rating upgrade for India in 13 years has narrowed the gap with China and widened the gap with Russia, Brazil and South Africa amongst the major Emerging Market economies that are part of the BRICS group.

Amongst these nations, India is the only one that has been upgraded recently. This upgrade offers significant implications for global institutional allocations to Indian Equities and Bonds as Institutional Investors such as Pension Funds, Endowments, Sovereign Wealth Funds etc. consider sovereign ratings as an important metric for making country allocations.

The opportunity is particularly positive for Indian financials that stand to benefit from reduced cost of borrowing as Banks and NBFCs raise substantial capital from the International bond markets. Even the appetite for Indian Masala Bonds will increase for international investors.

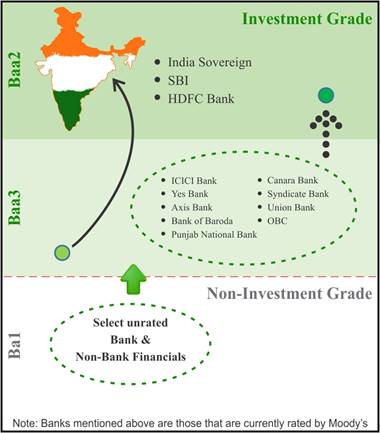

The chart here reflects the latest position of Indian ratings by Moody’s. As seen, a few select banks from the list shown in the chart, both from private and public sectors, that are currently rated at Baa3 (stable) have an opportunity to be upgraded to Baa2 in line with the upgrades announced for SBI and HDFC Bank.

The bigger and more exciting opportunity, however, is for those banks and NBFCs that did not choose to be rated earlier as they would have been rated Ba1 (Non-Investment Grade/ speculative / junk). Some of these businesses can now expect to get a Baa3 (Investment Grade) rating which would significantly lower their cost of funds raised in offshore markets.