Indian Financials: Set For A Comeback

April 2018

The first calendar quarter of 2018 witnessed a dramatic collapse of many financial sector stocks in India. Multiple headwinds came all together and led to a nearly 30% drop in the stocks of a few private sector and state owned banks, capital market intermediaries and asset and wealth management businesses. The start of April has been a turning point of sorts for this market leading sector and is set to bring the bounce back in some of the beaten down stocks.

We list below a few of the important changes that are going to influence this sector in 2018 :

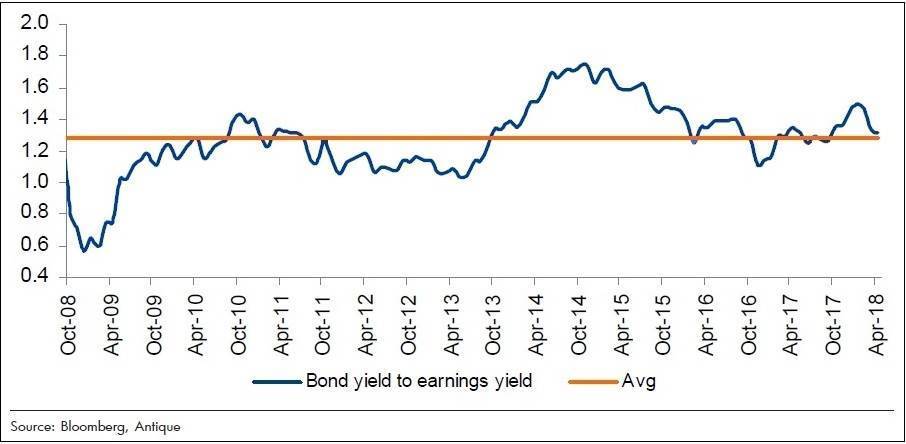

- Several measures taken by the Government and RBI have reinstated the optimism in bond markets. The ratio of bond yield to earnings yield, which had crossed 1.5, has fallen to 1.3 which has brought the relative attractiveness back in favour of equities. See the chart below which indicates the long term average ratio to be at 1.3 for India. Considering our outlook for the key variables that impact interest rates such as inflation, crude oil, fiscal position of the Government, global interest rates, GDP growth and demand for both wholesale and retail credit, we believe the Monetary Policy Committee to be on an extended pause in 2018. This would augur well for state owned banks and select highly-rated and rate-sensitive NBFCs.

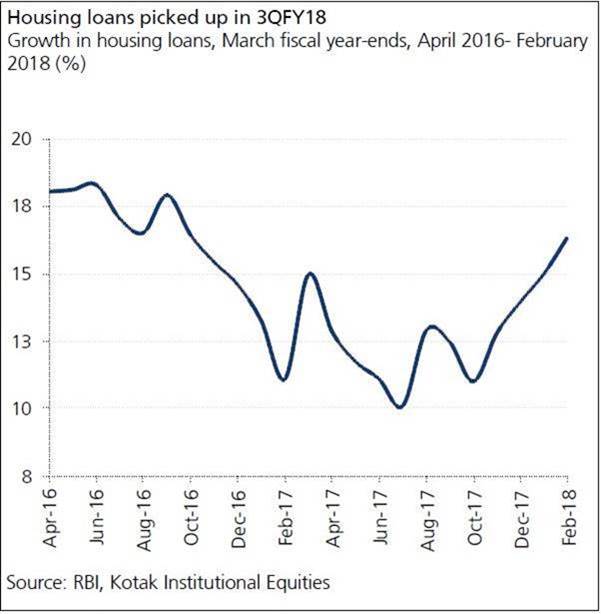

- Retail credit growth continues to be strong in the areas of housing, auto (both passenger and commercial vehicles) and unsecured loans(for consumer goods). The asset quality concerns in retail lending are still manageable. Micro-lenders such as Small Finance Banks are showing an acceleration in disbursements and recoveries. This is positive for consumption finance oriented NBFCs, vehicle financiers, select private sector banks that are market leaders in unsecured lending and a handful of state owned banks not under the PCA (Prompt Corrective Action) framework that are rapidly growing the secured lending books in housing and auto.

- Basis the higher than expected bids received for some of the large steel and cement NPAs, we are hopeful of a few significant resolutions to materialise at NCLT over the next few months. Corporate Banks, both in the private and public sectors, that have made significant provisions against the NCLT1 list of NPAs, have strong core Pre-Provisioning Operating Profits, comfortable CET1 capital positions and a strong retail liability franchise are set to bounce back. Some of these banks have a very material exposure to the NCLT1 steel accounts at over 20% of their overall NPAs. Successful resolutions of the three large steel NPAs of INR 500 billion each will thus go a long way in reducing the overall asset quality stress in these banks.

Overall, we are quite positive that the tide is turning back in favour of select financial sector stocks where valuations have been unreasonably impacted due to certain headline events in the recent past and where the margin of safety has become compellingly attractive.