September 2018 - One Of The Worst Months In A Decade For Financial Sector Stocks

September 2018

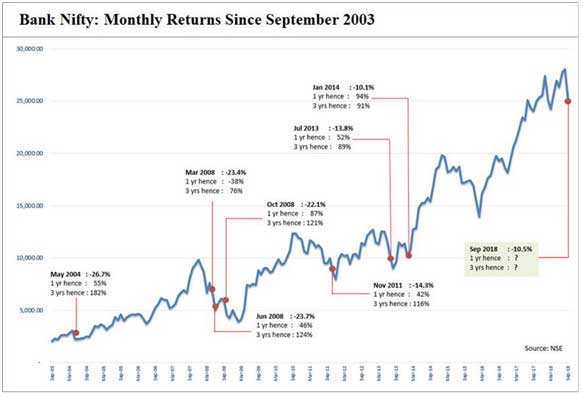

Nifty Bank index lost 11 percent in the month, which was one of the worst monthly performances since the Lehman crisis in 2008.

In a totally unexpected set of events, a systemically important financial institution, ILFS defaulted on its debt repayment obligations due to a severe mismatch in its assets and liabilities. The default created panic amongst some mutual fund investors who started pulling out their funds from the schemes that held positions in not just ILFS but in many other NBFCs perceived to be vulnerable to the refinancing risk. In order to meet the redemptions, mutual funds started selling commercial papers and bonds of these NBFCs at much higher yields. This impacted the stocks of these companies as the market started believing that some of the weaker NBFCs will become insolvent and may have to be bailed out. In addition to the NBFC related issues, we saw the crash in Yes Bank’s stock by 50% after RBI refused granting a new term to the bank’s MD & CEO.

Even though this seems to be an overreaction, it may take a few months to settle the markets. A few important metrics to closely watch as we get into the October-December quarter would be as under:

- The funding costs of NBFCs and HFCs will be distinctly higher as they are reliant on funding from the wholesale lenders such as banks, mutual funds and insurance companies. Some of these NBFCs will be able to pass on the higher costs to their borrowers and will maintain their margins while others will not be in a position to do so. Also, some of the weaker credit profiles amongst such Non- Banking franchises will have to cut growth aspirations as their funding lines will be quite constrained.

- The IL&FS problem will need to be solved first by equity capital infusion and then followed by sale of various infrastructure assets in their portfolio. This will be crucial for the stability of the market conditions and to revive the confidence amongst institutional lenders.

- RBI, in their October monetary policy, is expected to raise rates further. This will mean that the interest rate environment will stay elevated and will help the large banks with solid retail deposit franchises. In the previous interest rate cycle, the wholesale funding costs were closer to the retail term deposits as compared to what we think will be the case over the next few years. In such a scenario, the overweight stance on those large bank stocks which have modest valuations is expected to be profitable. Our portfolio is well positioned with the current allocation of 70 percent in banks.

The chart here shows how, over the past fifteen years since 2003, in all cases where the monthly returns for Nifty Bank dropped over 10%, the next three year returns were extremely attractive. In the 7 such scenarios displayed in the chart, the 3 year absolute returns were between 76% to 182%.