A Few Interesting Trends In The Financial Sector...

July 2019

Some interesting trends in the Financial sector are depicted in the following charts :

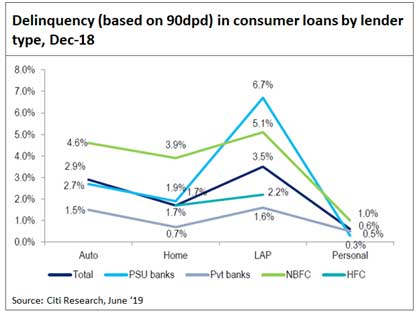

Figure 1: While the NPAs from industrial sector have come down in FY19, the Agriculture related stress has gone up. The asset quality in services and retail sectors is well in control which is good news as bulk of the incremental lending has been happening in retail.

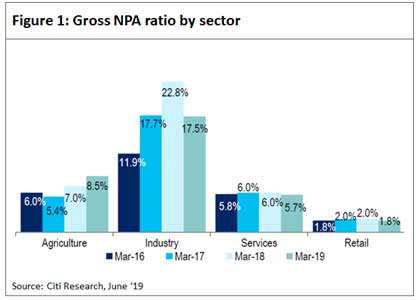

Figure 2: It is interesting to see how significantly the funding needs are shifting for the NBFCs from bond market issuances to bank financing. These shifts are likely to further intensify in FY20.

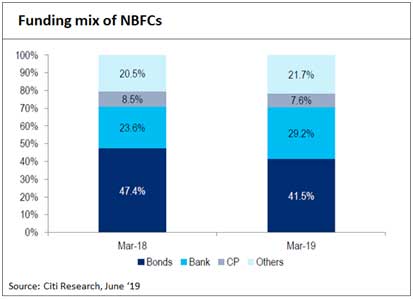

Figure 3: Private sector banks are best placed with respect to asset quality stress amongst all lender types. On the other hand, the delinquency for NBFCs / HFCs in the LAP (Loan Against Property) segment is high.