Indian Financial Sector - Key Developments

October 2019

As Fund Managers in India’s rapidly transforming financial sector, we experienced a roller-coaster ride past quarter, to put it mildly. In this note, I would like to highlight a few key developments that impacted this sector and our view on how to navigate these over the coming years.

- Financial Sector becomes more dominant:

By definition, the financial sector in any country dominates the large-cap indices. However, in India, the dominance became a bit too overwhelming with the sector’s weight in Sensex increasing to 44% and in Nifty to 40%. As fund managers specialising in this space, we often realise how rapidly the sector is evolving into a complex and mature investing opportunity in India. No other country presents such diversity and maturity in this sector as India does. The increasing market caps of the listed entities demonstrates the leap of faith investors have put in select banks and insurers. The Non-Banking Financial Companies (NBFCs), on the other hand, have seen declining market caps with very few exceptions.

- Most Non-Bank lenders are re-evaluating their business models:

Both, the cost and availability of funding, continue to pose challenges for most NBFCs / Housing Finance Companies (HFCs). The balance sheets are consequently shrinking with emphasis on increasing liquidity buffers and shoring up capital positions. These businesses are now looking to focus on co-originating loans for the partner banks and thereby increasing the fee income. In the process, their valuation multiples will adjust lower to reflect the new reality. Since the market values lenders on the “price to book” metric and not on the “RoE and PE” metrics, the sharp reduction in scale of these businesses will continue to impact the valuations. Extremely few Non – Bank lenders continue to provide comfort to their lenders in view of their dominance in their respective domains, parentage, efficiency and riskmanagement. In the context of HFCs, we believe that banks with large low-cost retail deposits such as SBI and ICICI will be able to offer cheaper funding options and thus increase market shares in the highest quality borrower segment which is obviously most sensitive to costs.

- Interest rates on advances and deposits turning floating:

Effective October, banks have to float their interest rates charged on lending to Retail / MSMEs to one of the prevailing benchmarks. Led by SBI, many banks have already announced Repo rate as the chosen benchmark. In our opinion, interest rates are close to bottoming-out in India and a series of fiscal measures taken by the Government will result in stimulating the economic growth and thus inflation. In the medium-term, therefore, the Repo rates are bound to go up in a capital deficient economy such as ours. Hence, a short-term disadvantage to the banks will become a compelling advantage in the medium/long-term.

- Select Private sector banks offer the best investment opportunity:

We are convinced that a few select private sector banks will continue to gain market share from state-owned banks and NBFCs / HFCs. In the current market context, the ability to raise equity capital and the ability to raise granular (and thus sticky) retail deposits are the two most precious and rare abilities for a financial institution.

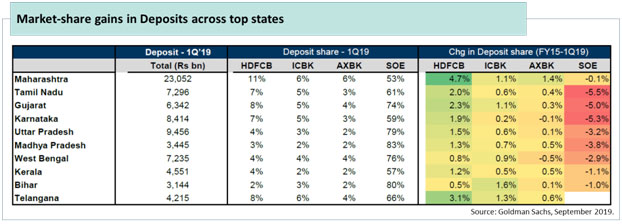

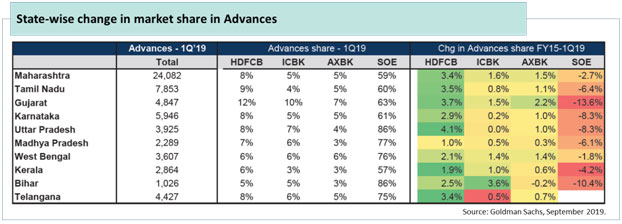

There are only a handful of banks that can achieve both these outcomes. HDFC Bank, ICICI Bank, Axis Bank and Kotak Mahindra Bankare four such banks that are best placed to make the most of a rare market opportunity that puts constraints on most other competing lenders. Of these, HDFC Bank and Kotak Mahindra Bank will maintain their expensive valuations and are the two anchor stocks in our portfolios. We believe ICICI Bank and Axis Bank will improve upon their modest valuations on the back of a sharp improvement in their RoAs / RoEs. Axis Bank, the only one in this list that was short on capital, has demonstrateditsability to raise capital in difficult markets by raising Rs. 12,500 crores of equity in one of the biggest QIP launches by a bank in India. For the next few years, state-owned banks will be busy dealing with the recently announced merger process while most NBFCs / HFCs will be constrained for liquidity. My interactions with a few members of the management teams of these private sector banks further validate this investment thesis. The three banks, with the exception of Kotak, also benefit from the scale and as we can see from these charts below have been able to gain market share in both deposits and advances across several leading states in the country.

Over the past few days, the market is once again focusing a lot on the emerging asset quality risks forthe financial sector. RBI’s action on Punjab and Maharashtra Co-operative (PMC)Bank triggered the speculation around the stress in real estate and its consequent impact on lenders. In our opinion, a few select private sector banks have built comfortable provision covers for the known stressed accounts and their exposures to the newly stressed names are limited.

In conclusion, the portfolio is well-positioned to benefit from the emerging trends in the Indian market place. The past yearhas been extremely challenging for the financial sector, in particular since the IL&FS episode last September. A positive portfolio return*since its inception in December ’18in the wake of significant erosion in stock prices of some Banks indicates that we responded quickly in making portfolio changes, though not in all cases.

* Actual client portfolio performance (net of expenses) since the date of inception (10 Dec ’18) as on 30 Sep ’19.

Disclaimers: In the preparation of this material, the Portfolio Manager has used information that is publicly available, including information developed in-house. Some of the material used herein may have been obtained from members/persons other than the Portfolio Manager and which may have been made available to the Portfolio Manager. Information gathered and material used herein is believed to be from reliable sources. The Portfolio Manager, however, does not warrant the accuracy, reasonableness and/or completeness of any information. For data reference to any third party in this material, no such party will assume any liability for the same. We have included statements/opinions/recommendations in this material, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, which are “forward-looking statements”. Actual results may differ materially from those suggested by the forward-looking statements. This material has been prepared by Trivantage Capital Management India Private Limited and is meant for information purposes only. The Portfolio Manager and its clients may be holding positions in the securities mentioned in this communication.