Indian Financial Sector - Q2 FY20 Earnings – Important Themes

November 2019

The earnings season for Q2 FY 2020 has recently concluded for the financial sector businesses. I would like to share with you a few important themes.

Starker polarisation amongst lenders

- While the Government infused additional capital into many Public Sector Banks (PSBs), not much was available for lending as the first objective of the capital infusion was to meet the regulatory minimums. Also, most PSBs are busy dealing with the merger process that could potentially distract them from the business for the next couple of years. SBI, the only exception to this, can focus on credit growth without having to deal with any such distractions.

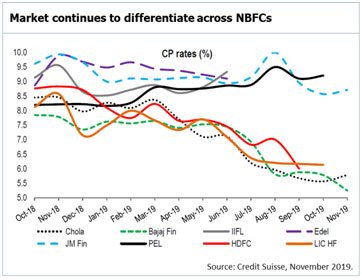

Most Non-Banking Financial Companies (NBFCs) / Housing Finance Companies (HFCs) are constrained for both equity and debt capital. With the exception of Bajaj Finance, HDFC Limited, Chola etc., most other Non–Bank lenders are unable to secure funding from the bond markets. Unable to refinance their balance sheet liabilities, they find no other alternative to changing their business model. Consequently, many such lenders are partnering with banks to originate lending deals in their circle of competence. With the inevitable shrinking of balance sheets, such businesses are losing their prominence in the markets. Investors will need to re-adjust their evaluation criteria from Price-to-Book and Return on Equity (RoEs) toReturn on Assets (RoAs) for such franchises.

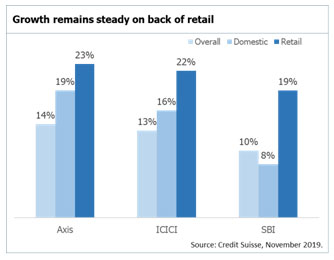

Most Non-Banking Financial Companies (NBFCs) / Housing Finance Companies (HFCs) are constrained for both equity and debt capital. With the exception of Bajaj Finance, HDFC Limited, Chola etc., most other Non–Bank lenders are unable to secure funding from the bond markets. Unable to refinance their balance sheet liabilities, they find no other alternative to changing their business model. Consequently, many such lenders are partnering with banks to originate lending deals in their circle of competence. With the inevitable shrinking of balance sheets, such businesses are losing their prominence in the markets. Investors will need to re-adjust their evaluation criteria from Price-to-Book and Return on Equity (RoEs) toReturn on Assets (RoAs) for such franchises.- A few erstwhile strong private sector banks are dealing with the newly formed asset quality stress while some others face the challenge of raising equity capital. In this situation, select banks such as HDFC, Kotak, ICICI and Axis find themselves in a sweet spot where they can pick and choose the segments in which to grow their credit books. These four have strong retail deposit franchises and can raise equity capital at will. Axis Bank recently raised equity of INR 125 bn in the largest QIP by any private sector bank till date. These four can comfortably grow at 5% over the nominal GDP growth for many years. Till the capex cycle starts, these banks are focused on retail growth to meet the growing housing and consumption demand.

Mixed asset quality trends

- While the resolutions of the NPAs formed in the previous cycle have slowed down,the Indian financial sector continues to face a series of incremental asset quality stress across sectors such as Real Estate, Housing Finance, Telecom, Travel, Media etc. In the process, it is important to evaluate each financial institution on a bottom-up basis. For banks such as ICICI, the equation has turned quite favourable with the incremental stress formation in a “normalised range”. SBI and Axis Bank may take a few more quarters to get there while IndusInd and RBL are facing higher proportions of stress than earlier. Fortunately, for the least impacted banks like HDFC and Kotak, the situation continues to be “business as usual” since all indicators point to stable asset quality trends in retail loans.

- For NBFCs and HFCs, the underlying cause of asset quality woes continues to be the Real Estate sector. Some recent developments relating to the creation of a special Alternative Investment Fund to provide the last mile funding to certain otherwise viable RE projects, is a welcome step.But we believe the impacted Non-Bank lenders will take a couple of years to bounce back to the levels existing before the IL&FS default episode.

Funding costs unlikely to fall much more

- We are somewhere towards the end of the interest rate reduction cycle in the context of policy rates. However, as we have seen, despite a few previous rate cuts, the funding costs have been rather sticky. India’s fiscal situation is quite stretched with below par revenues from direct & indirect taxes and increased demand for stimulating a slowing economy. The risk-free government bond yield curve has thus steepened with 10-years and above segment not falling in line with the very short-end.

- Keeping this in mind, the recent move to link the housing loans to a market benchmark rate will not bring down the borrowing costs by much whilst retaining the risk of a sharp uptick when rate cycle turns. Banks are thus well-placed as the threat of reduction in their Net Interest Margins is no longer likely to play out.

Capital market businesses awaiting better conditions

- The moderation in SIP volumes indicate the pressure of performance in most equity mutual funds over the past two years. The asset and wealth management businesses are showing a margin compression in addition to a decline in volumes. The rise in low margin ETFs is still quite modest but we should watch out for the trend of passive investing gaining strength in India too over the next decade.

- Some improvement in the recent market sentiment has led to a bounce in both cash and derivative market volumes.However, the investor interest in the listed brokerages will become stronger only if the “Risk-On” sentiment is sustained.

Private Insurers continue to gain market share

- General Insurance businesses are benefiting from the stricter Motor Vehicles Act that has led to a much better compliance with the renewal of vehicle insurance policies. The health insurance segment is also showing strong growth trends. Businesses such as ICICI General Insurance are making the most of this opportunity as they de-focus on the vulnerable crop insurance segment and focus on vehicle and health segments.

- As in the case of banks, the private sector continues to gain market share in the Life Insurance sector. Interestingly, SBI Life is included in the private sector since it is not directly owned by the Government. The three listed businesses HDFC, SBI and ICICI are focused on building the high margin protection business whilst simultaneously diversifying the distribution channels.

Our Outlook

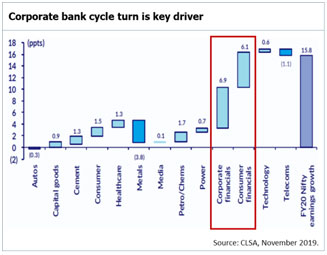

The recent Supreme Court judgement on the Essar Steel resolution is extremely positive for not just the Corporate Lenders but for India as a country. The verdict would help resolve one of the largest stressed assets helping inject INR 420 bn of liquidity to creditors. Banks such as SBI and ICICI had provided for 100% on this account and will thus write back most of the provisions. This resolution will also set the precedent for similar pending cases, thereby leading to quicker resolutions.

We continue to be overweight on Corporate Lenders in our portfolios as we have greater visibility of the RoE progression in a few banks and the valuation gaps continue to be attractive vis-à-vis retail banks.

Disclaimers: In the preparation of this material, the Portfolio Manager has used information that is publicly available, including information developed in-house. Some of the material used herein may have been obtained from members/persons other than the Portfolio Manager and which may have been made available to the Portfolio Manager. Information gathered and material used herein is believed to be from reliable sources. The Portfolio Manager, however, does not warrant the accuracy, reasonableness and/or completeness of any information. For data reference to any third party in this material, no such party will assume any liability for the same. We have included statements/opinions/recommendations in this material, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, which are “forward-looking statements”. Actual results may differ materially from those suggested by the forward-looking statements. This material has been prepared by Trivantage Capital Management India Private Limited and is meant for information purposes only. The Portfolio Manager and its clients may be holding positions in the securities mentioned in this communication.