Vantage Point

February 2020

Macro-Economic conditions continue to be challenging; LTROs offer some respite

The Consumer Price Index (CPI) in January ‘20 at 7.5% registered a high since June ’14. The ‘core inflation’ was also quite high at 4.2% on the back of hikes in telecom tariffs and gold prices. Given the mandate for Monetary Policy Committee (MPC) to maintain headline CPI within a range of 2% - 6%, cutting policy repo rates further is not easy.

However, RBI, in their bid to support the Government’s effort to revive economic growth, launched an indirect rate cut by introducing “Long-Term Repurchase Operations (LTROs)”. These 1 & 3-year Repos will be administered at the Policy Repo rate of 5.15%. At present, banks borrow 1 & 3-year money via term-deposits at rates above 6%. So, LTROs will bring rates down by about 100 bps in the 1 to 3-year tenors for the banks and eventually for the end borrowers.

Underlying demand conditions in the economy continue to be weak

- Most lenders, whether Banks or NBFCs, have pointed out to sluggish demand conditions in the economy.

- Auto sales were impacted by the impending BS VI transition effective April 1 2020. Many Auto OEMs have resorted to heavy discounting by clearing out the BS IV inventory.

- Demand for FMCG and Consumer products was impacted by a distinct “Rural Slowdown” due to which customers resorted to “down-trading” of products implying shifting to lower cost products.

- Order inflows were weak for Infrastructure Companies indicating pressure in the entire capital formation value chain.

- Octroi abolishment led to productivity gains and thus reduced capacity additions in the CV segment.

- Most businesses in their commentaries pointed to the highwater reservoir levels backed by strong monsoons and expectations of a robust winter crop as factors making them optimistic of improvement in consumer demand.

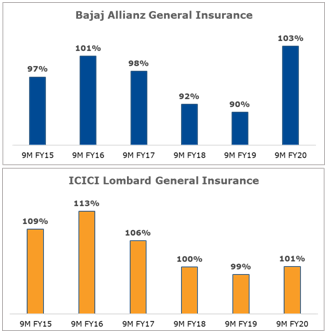

General Insurance businesses report higher combined ratios

Combined Ratio in insurance refers to the sum of claim related losses and general business costs divided by earned premiums. The ratio of less than 100% indicates running a profitable insurance business.

Combined Ratio in insurance refers to the sum of claim related losses and general business costs divided by earned premiums. The ratio of less than 100% indicates running a profitable insurance business.- The attached charts of both Bajaj Allianz General Insurance (BAGIC) and ICICI Lombard General Insurance (ICICIL) indicate that in 9M FY20, the trend of improvement in combined ratios got interrupted. This is attributed to rising claims in the crop portfolio & pricing pressures in the Motor OD book.

- ICICIL has, however, taken a policy decision to de-risk their business by discontinuing the crop insurance segment which is extremely volatile. This is likely to keep their combined ratios more stable as compared to the other general insurers.

Source: Earnings releases of the respective companies

Life Insurance businesses follow rather different business models

Private Insurers continue to grow through a combination of products and channels. SBI Life grew the ULIP business via their agency channel, ICICI Prudential increased their share of the protection business while HDFC Life focused on the Participation policies.

Asset Quality continues to pose headwinds to lenders

- Most banks reported an improvement in headline asset quality supported by a large corporate account resolution at NCLT, despite an uptick in slippages.

- The retail asset quality marginally deteriorated mainly due to the building of stress in the CV segment.

- Micro lenders reported stable asset quality with the exception of a few states such as Assam.

- Two NPA accounts (Dewan Housing and Cox & Kings) were classified as fraudulent leading to the provisioning being accelerated by banks.

- Additions to the BB and below bucket was high due to the situation in Telecom and Construction sectors.

- SMA (Special Mention Accounts) levels indicating impending NPAs improved for the leading banks such as ICICI, Axis and SBI.

- The importance of resolutions at NCLT continues to be high as a quarter of GNPLs are still pending resolutions at NCLT benches.

- The slowdown in autos and construction finance impacted disbursements by NBFCs.

- The growth momentum slowed down even for the best in class names such as Bajaj Finance.

Banks rely on Term Deposits as CASA deposits slow down; Net Interest Margins Improve

With the exception of Kotak Mahindra Bank which continues to grow its CASA deposits and maintains this ratio at the industry highest level of 53%, other banks are finding it tough to grow these at low rates. The credit growth is hence funded by term deposits.

Cost of funds is coming down for banks, leading to improvement in NIMs. Kotak Mahindra Bank’s NIM stands at the highest level of 4.6%.

Our Outlook

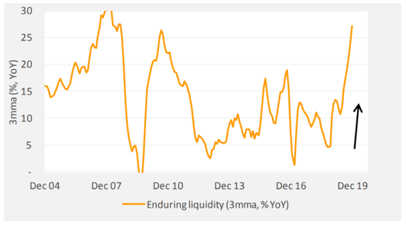

Markets will take advantage of the abundant liquidity conditions both globally and in India. The chart alongside shows how the durable liquidity growth is the highest in a decade. RBI’s liquidity stance is quite clear in favour of maintaining surplus liquidity.

Markets will take advantage of the abundant liquidity conditions both globally and in India. The chart alongside shows how the durable liquidity growth is the highest in a decade. RBI’s liquidity stance is quite clear in favour of maintaining surplus liquidity.

The economic slowdown has been much sharper than expected by us and we believe that the recovery will be gradual.

Source for Charts: Edelweiss

Disclaimers: In the preparation of this material, the Portfolio Manager has used information that is publicly available, including information developed in-house. Some of the material used herein may have been obtained from members/persons other than the Portfolio Manager and which may have been made available to the Portfolio Manager. Information gathered and material used herein is believed to be from reliable sources. The Portfolio Manager, however, does not warrant the accuracy, reasonableness and/or completeness of any information. For data reference to any third party in this material, no such party will assume any liability for the same. We have included statements/opinions/recommendations in this material, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, which are “forward-looking statements”. Actual results may differ materially from those suggested by the forward-looking statements. This material has been prepared by Trivantage Capital Management India Private Limited and is meant for information purposes only. The Portfolio Manager and its clients may be holding positions in the securities mentioned in this communication.

Statutory Details: Trivantage Capital Management India Private Limited is a private limited company incorporated under the Companies Act, 2013 and having its registered office at 508, Arcadia, NCPA Marg, Nariman Point, Mumbai – 400 021, India and is registered with Securities and Exchange Board of India as a Portfolio Manager vide Registration Number INP000004656