Vantage Point

March 2020

The 15-year valuation history of 7 leading bank stocks highlights a very differentiated market response to each bank in the current meltdown. Therein lies a very compelling opportunity to invest in a few of those banks that in our opinion are misaligned with their prospects in the current phase of indiscriminate selling.

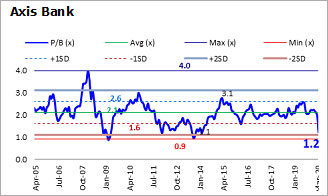

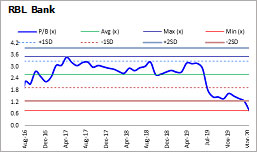

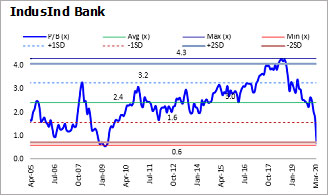

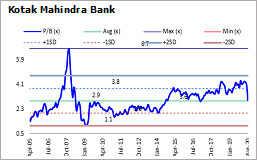

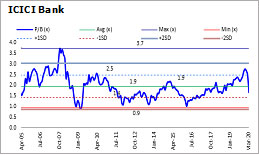

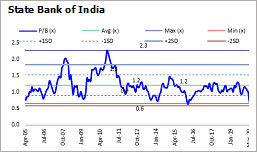

The valuation history is nicely depicted by the following charts over 15 years beginning April 1 2005. In the case of RBL Bank, the period covered is since itslisting in August 2016. Price/Book is taken as the valuation metric.This metric is then compared with the historic valuations for each bank. The valuation range is from a historic Maximum to Minimum and +2 standard deviations to -2 standard deviations in between. Given this analysis, we have categorised the banks as per their present valuation status.

Category 1: Banks at their Valuation Max or +2 SD or even +1SD

None of the banks fall in this category, which is understandable. We are witnessing one of the worst economic crisis driven by one of the worst healthcare crisis. In this environment, the credit markets become extremely vulnerable with a severe slowdown in incremental credit disbursements and, more importantly, delays and defaults in repayments leading to credit losses. In this situation, if any lender is at a 15 year historic higher than average valuation then that would be a clear case of overvaluation.

Category 2: Banks at their Historic Average Valuations

Only Kotak Mahindra Bank is in this category and we entirely agree with the market’s decision to value this bank at the valuation level “best-placed among universal banks”. The bank has been extremely cautious in their underwriting decisions and as such is best placed in terms of potential credit losses. They have laboriously built a granular savings bank deposit franchise and sit at the industry highest CASA deposits at 53% of total deposits.

Only Kotak Mahindra Bank is in this category and we entirely agree with the market’s decision to value this bank at the valuation level “best-placed among universal banks”. The bank has been extremely cautious in their underwriting decisions and as such is best placed in terms of potential credit losses. They have laboriously built a granular savings bank deposit franchise and sit at the industry highest CASA deposits at 53% of total deposits.

Investors in Kotak Mahindra bank also get to participate in a whole range of mid-sized but well-managed bouquet of financial services businesses ranging from asset management to insurance. The bank’s net interest margins are also amongst the highest in banks at over 4.5%.

Category 3: Banks at between average and – 1SD valuations

ICICI Bank is placed in this category. We can understand why the market is a bit more cautious on this bank as compared to Kotak. The re-rating of the bank had well begun over the past year on the back of progression of RoE from a modest single-digit to 15%.However, in the current context, the market would like to, once again, evidence the underwriting standards after a very disappointing experience in the previous cycle.

ICICI Bank is placed in this category. We can understand why the market is a bit more cautious on this bank as compared to Kotak. The re-rating of the bank had well begun over the past year on the back of progression of RoE from a modest single-digit to 15%.However, in the current context, the market would like to, once again, evidence the underwriting standards after a very disappointing experience in the previous cycle.

In our opinion, this presents an opportunity to add to this stock as we are confident that the big-ticket chunky credit losses are unlikely to be repeated and that the bank will grow at over 5% of India’s nominal GDP growth rate. The bank’s subsidiaries are leading businesses in their respective financial services domains which will continue to provide support to the stock. We think the stock will bounce back to the historic average valuations and will, together with Kotak Bank, move towards the +1SD levels as the present crisis starts stabilising.

Category 4: Banks at -2 standard deviations

|

|

|

HDFC Bank and Axis Bank are placed in this category. To many, it would be surprising to see HDFC Bank in this category and may think of this as an opportunity. We understand that the market is concerned with the high level of unsecured loans at this time of economic downturn and the uncertainties relating to the leadership transition. The stock is now likely to bounce back towards its long term average valuations once the process of change in leadership is satisfactorily concluded.

On the other hand, we believe that Axis can bounce back from -2SD to -1SD, as it follows the upward transition of RoE after a lag of 2-3 quarters when compared to ICICI Bank and as the new management team, builds on their track record of conservative underwriting.

Category 5: Banks at historic minimum valuations

SBI, RBL Bank and IndusInd Bank feature in this category. RBL and IndusInd are currently facing the worst set of variables in their history from credit losses to a severe moderation in the growth of deposits and advances. IndusIndis also experiencing the leadership transition after 12 years of stability at the top.

|

|

|

We, however, think that SBI is likely to benefit in terms of movement of low-cost deposits from smaller private sector banks post the Yes Bank episode.

We, however, think that SBI is likely to benefit in terms of movement of low-cost deposits from smaller private sector banks post the Yes Bank episode.

SBI’s high credit losses in the industrial segment are largely dealt with and a substantial provision coverage position cushions any material dents to profitability.

The listed subsidiaries of SBI Life and SBI Cards also provide support to the stock. In our opinion therefore SBI, like Axis is likely to move towards -1SD very quickly.

In conclusion, the present market melt-down has led to an indiscriminate collapse in valuations which when looked at in a historical context provides us with an opportunity to add to what we think are mis-priced stocks.

Source for Charts: Motilal Oswal Securities Ltd

Disclaimers: In the preparation of this material, the Portfolio Manager has used information that is publicly available, including information developed in-house. Some of the material used herein may have been obtained from members/persons other than the Portfolio Manager and which may have been made available to the Portfolio Manager. Information gathered and material used herein is believed to be from reliable sources. The Portfolio Manager, however, does not warrant the accuracy, reasonableness and/or completeness of any information. For data reference to any third party in this material, no such party will assume any liability for the same. We have included statements/opinions/recommendations in this material, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, which are “forward-looking statements”. Actual results may differ materially from those suggested by the forward-looking statements. This material has been prepared by Trivantage Capital Management India Private Limited and is meant for information purposes only. The Portfolio Manager and its clients may be holding positions in the securities mentioned in this communication.

Statutory Details: Trivantage Capital Management India Private Limited is a private limited company incorporated under the Companies Act, 2013 and having its registered office at 508, Arcadia, NCPA Marg, Nariman Point, Mumbai – 400 021, India and is registered with Securities and Exchange Board of India as a Portfolio Manager vide Registration Number INP000004656