Vantage Point

April 2020

The current market volatility due to the global pandemic has been very unnerving for investors across the world. Given the prevalent conditions, we would like to share our views & outlook on the markets.

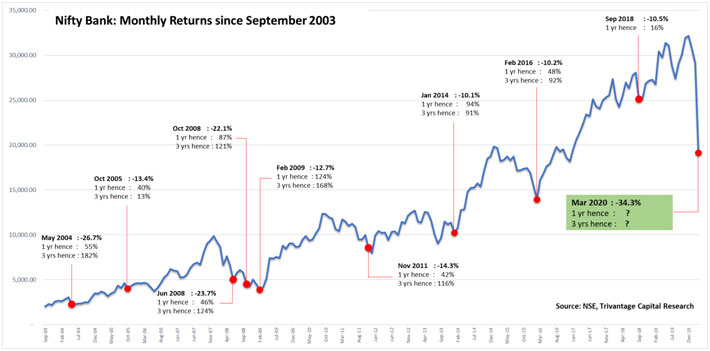

The Nifty Bank index has fallen by 34.3% in March 2020 (the sharpest fall since the inception of the index). The impact on the markets has been severe as the market has not experienced this combination of a healthcare and economic crisis. It is therefore not easy to merely project history this time and estimate the period for economic recovery.

However, in an environment such as this, a few select leading businesses are well-poised to gain market shares in both deposits and advances. These businesses will also be able to cut costs in a weaker operating environment and thus, to some extent, will not let their cost-income ratios get much impacted. Most of these leading stocks have also corrected around 30-40 percent and should bounce back the quickest over the next year.

Amongst the lenders, we are positive on a few private sector banks that have comfortable solvency, capital adequacy buffers, granular deposit franchise, high provision coverage and strong digital operating platforms. Also, we are positive on a few non-lending financials such as in general insurance, life insurance and asset management.

The chart below depicts many such “drawdown events” since September 2003 when the Nifty Bank index fell by over 10% in a month and subsequent 1-year & 3-year returns from the end of the impacted month. As can be observed, the subsequent period returns have been extremely attractive in almost all such cases. We are confident that a carefully chosen portfolio of financial sector businesses described above would very likely generate smart returns over a 3-year period.

The market has been indiscriminate in selling all financial sector stocks and we believe that as always, certain stronger businesses will not just survive but will thrive in the challenging conditions. We quote from The Economist, “Downturns are capitalism's sorting mechanism, revealing weak business models and stretched balance sheets. In the past three recessions, the share prices of American firms in the top quartile rose by 6% while in the bottom quartile fell by 44%.”

Disclaimers: In the preparation of this material, the Portfolio Manager has used information that is publicly available, including information developed in-house. Some of the material used herein may have been obtained from members/persons other than the Portfolio Manager and which may have been made available to the Portfolio Manager. Information gathered and material used herein is believed to be from reliable sources. The Portfolio Manager, however, does not warrant the accuracy, reasonableness and/or completeness of any information. For data reference to any third party in this material, no such party will assume any liability for the same. We have included statements/opinions/recommendations in this material, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, which are “forward-looking statements”. Actual results may differ materially from those suggested by the forward-looking statements. This material has been prepared by Trivantage Capital Management India Private Limited and is meant for information purposes only. The Portfolio Manager and its clients may be holding positions in the securities mentioned in this communication.

Statutory Details: Trivantage Capital Management India Private Limited is a private limited company incorporated under the Companies Act, 2013 and having its registered office at 508, Arcadia, NCPA Marg, Nariman Point, Mumbai – 400 021, India and is registered with Securities and Exchange Board of India as a Portfolio Manager vide Registration Number INP000004656