Growth: Real Or Nominal Or A Myth?

December 2015

This week witnessed the release of GDP and Fiscal Deficit data on Tuesday and the Monetary Policy today.

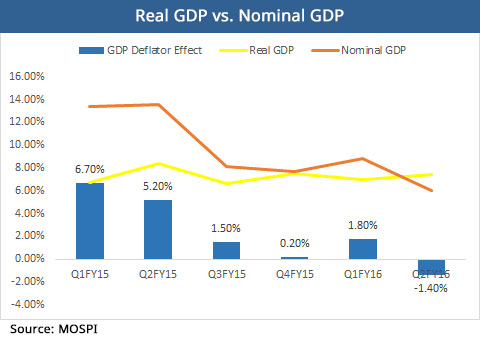

While the Fiscal Deficit data was in line with expectations, the data on GDP had some surprises. The Real GDP growth rate is 7.4%, higher than the Nominal GDP growth rate of 6%. This is contrary to the thumb rule which states that in a growing economy, the Nominal GDP growth rate is expected to be higher than the Real GDP growth rate.

The graph alongside shows that the relationship between Real vs. Nominal GDP has been consistent with this thumb rule, except for the latest set of numbers. This anomaly is on account of a negative GDP Deflator effect, which could have 2 possible reasons.

- GDP deflator, by definition, is an inflation parameter that considers price changes in the entire economy in contrast to WPI (Industry bias) and CPI (Services Bias). However, in case of India, the GDP Deflator shows a stronger correlation with WPI than CPI in spite of services contributing ~60% to the GDP. This has caused distortion in the form of over-estimation of real growth, since the WPI numbers are currently negative.

- Another possibility is that of over-supply, which might explain the higher GDP growth but lowering inflation. In case of over-supply, the production increases the GDP numbers, but a lack of corresponding demand growth keeps the price suppressed. In the September monetary policy, the RBI Governor had raised concerns regarding under-utilisation of the industrial capacity, while a subsequent report pegged the capacity utilization at 70%. Negative output gap doesn’t augur well for a strong growing economy.

The underlying theme is that while the economy has grown, its magnitude may not be as large as reported and it would require some more handholding to keep it on the growth track. Given this situation, the rate cut of 50 bps in September is interesting since the RBI Governor would have been concerned about the faltering growth.

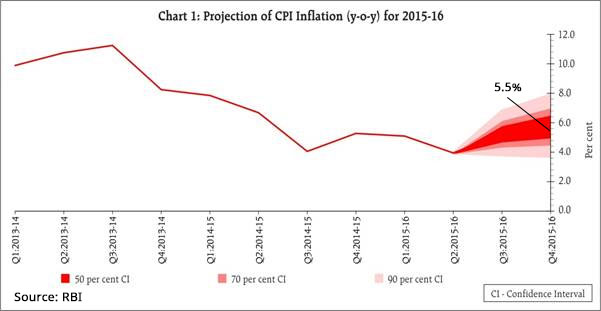

The Inflation numbers have been progressing along RBI’s projections with the December monetary policy reiterating prior estimates of 5.5% CPI by March 2016.

While increase in services inflation growth gives rise to caution, the decrease in manufacturing inflation lends comfort due to its higher weightage. Going forward, inflation expectation is benign with the RBI seeming to be in control of the situation adding to the comfort.

In the September monetary policy, RBI had mentioned targeting real interest rate of 150-200bps, which being 1-year forward rates over the inflation number. As per our calculations, the March 2016 implied 1-year forward rate is 7.5%. With the RBI projection of 5.5% inflation in March 2016 and an assurance of “Accommodative” policy, there is room for a 25-50 bps cut in rates.

Our View We expect the central bank to cut 25-50 bps in the current Fiscal after the Union Budget. This view takes into account growth concerns, benign inflation and accommodative room in the monetary policy. However, an aggressive rate hike schedule by the Fed or a rebound in global commodity prices could entail a rethink of the macro-economic situation.