2016 – The Road Ahead

January 2016

With 2015 behind us, it is but fair to look back and recognize it as a tough year for domestic markets.

The global factors like Fed rate hike and China growth concerns along with domestic ones like Fiscal Prudence, the slow pace of reforms and Credit quality scare made it a difficult year.

As 2016 dawns upon us, a fresh look at the economic situation is warranted.

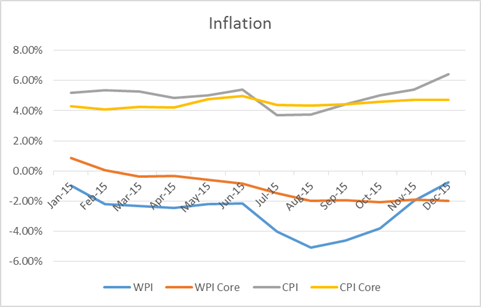

Inflation:

The main worry of Governor Rajan’s term now seems to be tamed. Both measures of inflation; CPI and WPI have been displaying a consistent moderated trajectory. The WPI has been in the negative territory for the entire year while the CPI has been hovering around in a comfortable 5% vicinity. The core WPI (red line) is rapidly slipping further into negative territory. Core WPI tracks the non-food manufacturing and is a proxy for the price increase of overall manufactured goods. In light of the global deflationary trend, this is a worrying sign, especially considering that there have been policy rate cuts of 125bps in this calendar year.

Across the globe, most economies are in a low growth / deflationary trend. Large economies like Euro-Zone, Japan, Australia and till recently USA are creating excess liquidity to devalue their currency and re-inflate their economy. In a scenario where countries are adopting a ‘beggar-thy-neighbor’ policy, where each economy tries to benefit at the expense of others, India will witness imported deflation, early signs of which are already being reflected in the Core WPI above.

A declining nominal GDP as well as capacity under-utilization in important sectors suggest that the output gap has not narrowed. This will continue to act as a buffer and moderate future price increases.

GDP Growth:

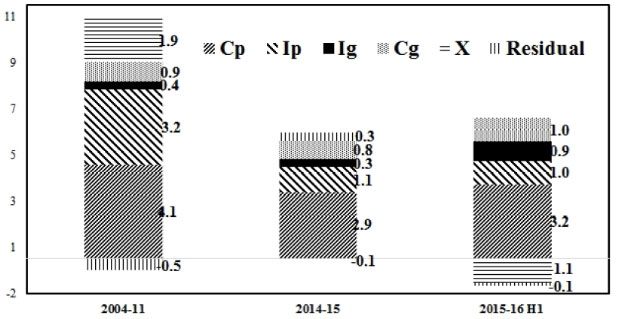

Having tamed inflation, creating demand should be the next task for policy makers this year. Given the pace of global growth, India has to look inwards for creating domestic growth. An analysis of the demand components of growth of GDP throws up interesting facts. The graph below depicts contribution of demand components towards GDP in 3 separate time periods.

As we can see, the government spending and private consumption have been the main drivers of India’s growth in the current fiscal while historically, all 4 components have delivered.

Government spending (Ig) is higher than the previous fiscal and also the long term average of the so-called boom years. Any further increase in government spending might be disastrous for the fiscal deficit and affect the sovereign credibility amongst global investors.

The private consumption (Cp) has managed to compensate for the negative exports growth at a rate higher than the last fiscal, but is still away from the average. The incremental private consumption can be attributed to lower interest rates, most of which is transmitted through NBFCs accessing the bond markets. Any further rate cuts will have an immediate impact on private consumption.

To create a sustainable demand and GDP growth rate, exports and private investment need to pick up. Exports (X) are largely dependent on the global factors and hence is expected to take some time to pick up.

Private investments (Ip) are constrained by the over-leveraged corporate balance sheet and deleveraging will take a couple of more quarters to happen. Initiatives like new base rate calculation methodology will be beneficial for fresh borrowers, as the impact of lower marginal rates will be immediately passed on. Policy rate cuts effected in the current calendar year and any new policy rate cuts will help speed up the process of deleveraging the healthy corporates thus spurring investment albeit with a lag.

In the New Year, policy makers have to make a choice between:

- letting the fiscal targets get extended and create growth through government spending, or,

- delivering on important reforms like GST, UDAY and INDRADHANUSH along with creating easy credit conditions to kick start private investments and spur private consumption.

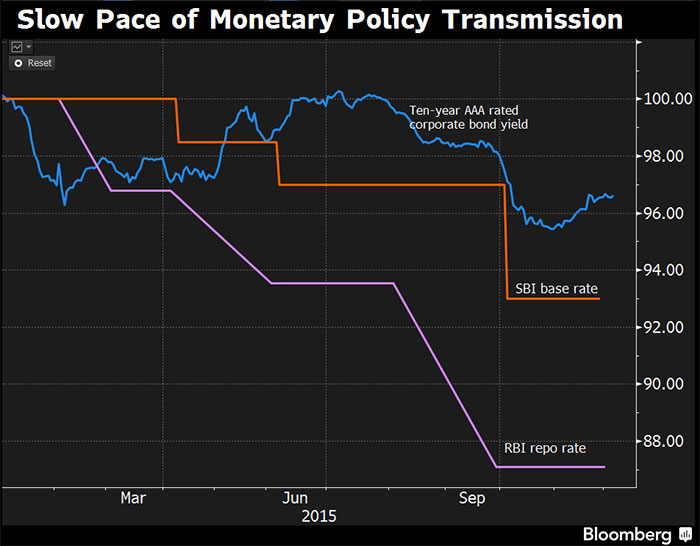

Bond Markets: Over supply

One of the biggest disappointment of 2015 was the non-transmission of the policy rate cuts.

There is still a 100 bps spread between the bond market and the bank lending rate for a 10-year AAA Corporate. The bond markets will keep facing tremendous supply from corporate bonds as long as this mismatch exists. Primary issuances in corporate bonds saw record volumes with 4.1 trillion rupee denominated issuances in 2014 and 4 trillion worth of issuances in 2015.

The expanded debt raising programs of state governments, expected higher debt borrowing by the GOI and DisCom debt restructuring program UDAY are only expected to add to the supply glut. On the other hand, bank credit offtake has been dismal and a major component of incremental credit has been to sectors under stress. This indicates that loans have been taken for balance sheet purposes rather than investments. RBI has proposed a new base rate calculation method based on the marginal cost of borrowing. This method when fully implemented will reduce the cost of fresh bank borrowing and help in easing the supply glut in the bond markets by reducing the gap between bond market and bank lending rate.

Our View:

The Government does not have the luxury of deferring the fiscal targets. The only growth drivers available are private investment and private consumption, both of which will need easier credit and the government to deliver on the promised reforms.. We expect to see further policy rate cuts of 100bps. The transmission of policy rate into bond markets will depend on the success of the new base rate calculation methodology among other factors.