Indian Yield Curve Set For “Bull Steepening”

April 2016

A very significant yet not much analysed decision taken by India’s central bank to change the liquidity stance from “deficit” to “neutral” will lead to a distinctly better transmission of monetary policy.

The new policy will have a marked impact on the short term yields as the current liquidity deficit of INR 1.3 trillion starts coming down. Bank lending rates which are now linked to “marginal cost” will automatically start moving down.

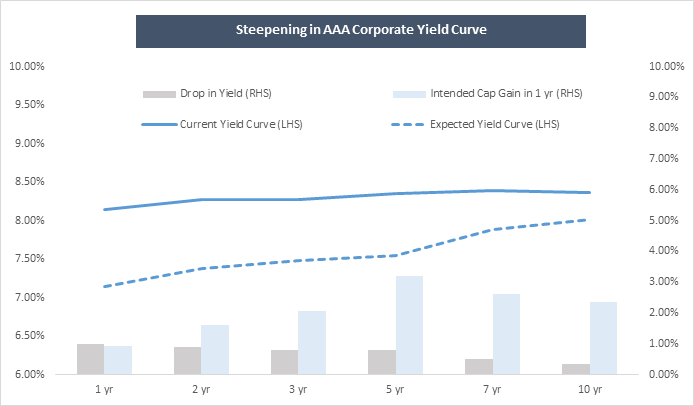

Whilst we expect the nominal interest rates to ease across board we expect changes in the structure of the yield curve itself. Since 60% of all Government borrowing in FY 2017 is focussed on the 10 to 14 year segment of the yield curve and since RBI prefers to buy back shorter tenor bonds via open market operations it is quite clear to us at Trivantage Capital that the yield curve is set for “bull steepening”.

We believe that a portfolio of highest investment grade corporate bonds ( locally rated AAA ) in the 3 to 5 year maturity bucket will outperform all other segments of the yield curve over the next 12 months in terms of absolute returns on investment.